Our What Is Trade Credit Insurance PDFs

Wiki Article

What Is Trade Credit Insurance Fundamentals Explained

Table of ContentsFacts About What Is Trade Credit Insurance RevealedThe Ultimate Guide To What Is Trade Credit InsuranceWhat Is Trade Credit Insurance Can Be Fun For EveryoneThings about What Is Trade Credit InsuranceWhat Does What Is Trade Credit Insurance Mean?

Trade credit scores insurance (TCI) compensates business when their consumers are incapable to pay as a result of insolvency or destabilizing political problems. Insurance firms generally value their plans based on the dimension and number of clients covered under the policy, their creditworthiness, and the danger intrinsic to the sector in which they run., which means the company creates its very own reserve fund especially created to cover losses from unpaid accounts. The downside to this method is that a business might have to set apart a considerable quantity of capital for loss avoidance instead of utilizing that cash to expand the service.

A variable generally acquires the right to those receivables at a significant discountusually 70% to 90% of the invoiced quantity. The creditor may obtain a bigger percentage if the aspect takes care of to accumulate the full debt, yet it still needs to pay a substantial fee for the factor's solutions.

Basically, it's an assurance from the purchasing firm's bank that the vendor will be paid completely by a specific date. Among the disadvantages is that these can only be gotten and also spent for by the purchaser, which might be hesitant to pay the purchase fee amount for the financial institution's assurance.

Some Known Factual Statements About What Is Trade Credit Insurance

That represents a compounded yearly development rate of 8. 6%.

Rise in sales as well as earnings A credit rating insurance coverage can normally counter its very own cost lot of times over, even if the insurance policy holder never makes an insurance claim, by enhancing a firm's sales as well as earnings without added risk. Boosted lender connection Trade debt insurance coverage can enhance a firm's relationship with their lender.

With profession credit scores insurance policy, you can reliably manage the commercial and political dangers of profession that are beyond your control. Trade credit scores insurance coverage can assist you feel safe in prolonging a lot more credit rating to present customers or pursuing new, larger clients that would have otherwise seemed too dangerous. There are 4 kinds of trade credit rating insurance, as described below.

The Ultimate Guide To What Is Trade Credit Insurance

Whole Turn over This kind of profession credit insurance policy shields versus non-payment of business debt from all customers. You can choose if this protection uses to all domestic sales, international sales or both. Key Accounts With this kind of insurance coverage, you choose to guarantee your biggest clients whose non-payment would certainly pose the best risk to your service.Transactional This type of profession credit score insurance coverage protects against non-payment on a transaction-by-transaction basis and is finest for firms with few sales or only one customer. Impressive debts are not covered unless there is direct profession between your organization and also a client (one more business).

It is generally not the most reliable solution, because rather than spending excess resources into growth possibilities, a business should put it on hold in case of uncollectable loan. A letter of debt is one more choice, yet it just gives debt protection for one customer and also just covers international trade.

The aspect offers a cash development varying from 70% to 90% of the billing's value. When the billing is gathered, the aspect returns the balance of the invoice minus their fee. These expenses may vary from 1% to 10%, look at here now based upon a variety of components. Some factoring services will presume the threat of non-payment of the invoices they acquire, while others do not.

Excitement About What Is Trade Credit Insurance

Nevertheless, while receivables factoring can be helpful in the temporary, you will certainly need to pay fees varying from 1% to 5% for the solution, even if the receivable is paid in full within 60-90 days. The longer the receivable remains unsettled, the greater the charges. Settlement warranties aren't always readily available, as well as if they are, they can increase factoring fees to as high as 10%.The financial institution or factor will certainly offer the funding and also the credit score insurance coverage plan will protect the invoices. In this instance, when a funded invoice goes overdue, the claim payment will certainly most likely to the funder.

Can your service pay for a negative financial obligation? Credit insurance coverage shields your money circulation. It covers your profession with your customers, to ensure that you still earn money also if they go under or fail to pay you. Trade debt insurance works by insuring you versus your buyer failing to pay, so every billing with that said customer is covered for the insurance policy year.

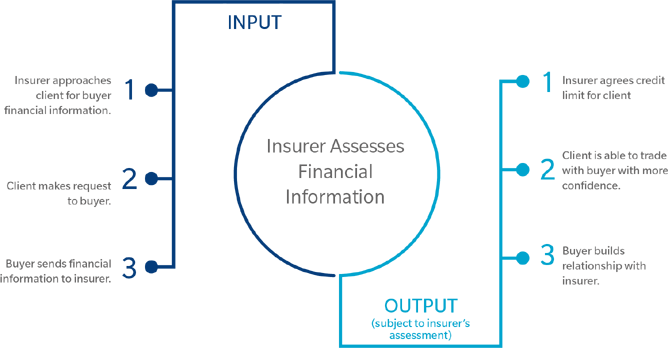

Many insurance coverage options will as a result be tailored to your demands. At Atradius Australia, we operate a Modula Credit history Insurance Coverage Policy. This allows us to tailor the web link plan to your demands. Atradius Debt Insurance policy clarified: Your credit rating insurance provider ought to keep an eye on the financial wellness of your consumers and also prospective customers and also apply a threat rating, commonly called a purchaser score.

Fascination About What Is Trade Credit Insurance

It will assist just how much of your exposure they are go to this site prepared to insure. The customer rating is likewise a valuable device for you. You can use it as a guide to sustain your own due diligence as well as assist you avoid possibly risky consumers. A solid customer ranking can likewise aid you secure possible purchasers by providing them favourable credit report terms.

Report this wiki page